Colombian Entrepreneur Martin Schrimpff Is Making The Dream of Vacation Home Ownership a Reality Via Kocomo

Table of contents

The Org speaks with Martin Schrimpff, co-founder of Kocomo, a company that is making owning a vacation home a more pleasant experience.

Martin Schrimpff is a proud Colombian with a British accent -- quite the mix. An avid skier and kite surfer, he is familiar with risk taking and enjoying the journey of the unknown.

From an early age it was evident Schrimpff had a knack for entrepreneurship. Combining a hustling mentality from his days selling chocolate at school with the creativity genes passed on from his photographer and aviator father; it was simply a matter of when, not if, Schrimpff started a business.

On graduating from university in the U.K., Schrimpff had secured a promising job in investment banking. But it was during a trip through Egypt with some friends, while on a scenic Nile river boat, that they decided spending life as investment bankers was simply not their cup of tea.

Long story short, Schrimpff and his friends, now purposely unemployed, headed back to Colombia and looking for something to do, stumbled upon the greatest opportunity they didn’t know existed.

Starting from scratch

Back in Colombia in 2002, Schrimpff and his childhood friend Jose Velez, who was very knowledgeable in programming when it wasn’t a widely known skill, seized an opportunity to become a more inexpensive software development outsourcing company for European clients. Their startup, Sirius, was met with apprehension and the idea quickly dwindled.

But in a turn of events, Schrimpff and Velez -- now a multiple time co-founder and entrepreneur -- were approached by a friend of a friend who worked at DeRemate.com, now part of giant Mercado Libre, with a request to set up a payment platform to the likes of PayPal, which had just been sold for $1 billion. Not ones to shy away from a challenge, or an opportunity, they got to work building Pagos Online.

Promising digital transactions, Pagos Online began operations in a market that was premature. Clients started using what seemed a very high tech service for banking transactions, when in reality Schrimpff and his team were “operating old school and going to bank branches and doing transfers manually.” This initially worked given the small client base and because they were “very naive when they began the company” and had no clue about the market size, “which turned out to be pretty much non-existent” Schrimpff said.

Just a year later, having a small number of clients and massive fraud problems, nearly broke the company. While weathering the storm, Schrimpff and Velez lost an investor/co-founder, and shifted the company’s focus to fraud control, for obvious reasons, and that became their competitive advantage.

Pagos Online grew organically until 2009 when it received investment from Naspers. The capital injection allowed the startup to grow to more than 16 countries and generate upwards of $300 million in revenue.

In 2017, Schrimpff sold the majority of his stake in the company that is now known as PayU. It was his first ‘exit’ and one that allowed him to retire early if he desired.

Failed Early Retirement

Having moved to Mexico in 2015 towards the end of his Pagos Online involvement, Schrimpff had some newfound free time and invested in and advised Zinobe, a data driven fintech that develops products and services for the underserved. Services include a proprietary technology platform that enables product versatility and speed-to-market, advanced AI scoring for intelligent decision-making in non-traditional markets and cutting edge security that leverages blockchain technology.

Happily married with three kids, Schrimpff was living a “pretty comfortable and relaxed life” post exit, but he kept telling himself, “I’m too young to go and play golf the rest of my life.”

In 2020 he began toying with the idea of setting up a fund with his close friend Bryan Requarth, founder of proptech startup Viva Real that sold for over half a billion dollars last year. The fund idea pivoted (although Requarth did end up founding Latitud, a fund for Latin American entrepreneurs) and along with another close friend, Tom Baldwin, Kocomo was dreamt up.

Kocomo

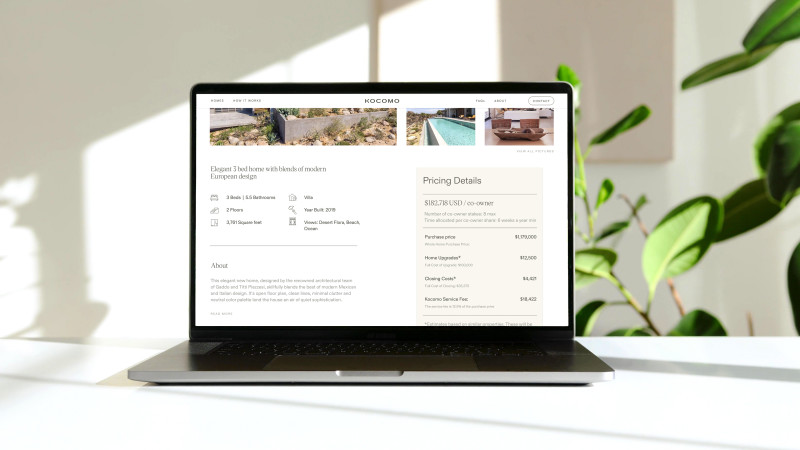

The startup, founded in April 2021, is a marketplace for home co-ownership.

Kocomo is making owning a vacation home -- starting with properties in Mexico -- a more pleasant experience. Aspiring homeowners can purchase anywhere between an eighth and up to half of the property and Kocomo takes care of all the ‘less attractive’ aspects of home ownership, ultimately “avoiding fights between friends” as Schrimpff jokingly describes.

The main services provided by the startup include curating home furniture and decoration for a crisp and elegant retreat, time allocation and swapping assistance, property management and, in the near future, the team wants to get into the fintech side of the business, providing mortgages and credits directly to buyers.

Just four months into operations, Kocomo raised $56 million from Architect Capital, ALLVP and Vine Ventures in the form of $50 million debt financing and a $6 million seed round, which Schrimpff mentions they were oversubscribed for. The capital will be used to further acquire Kocomo properties, averaging a $2 million-$3 million price tag.

Schrimpff highlights that this “co-ownership model done in a professional way is a global play” and he expects the business to thrive worldwide. Current buyers are mostly from North America looking for a Mexican escapade, but in the near future the team anticipates a more global client base looking for properties in the Caribbean, Europe and Asia.

Kocomo is a tech company at heart that leverages data and customized software to track client payments, schedule time allocation at the property via a draft system and keep track of owner profiles and preferences so when they arrive, the house feels like home. Schrimpff says combining real estate and tech allows the team to provide a seamless experience for the property owners and more importantly to keep transparency at their core, “as every financial transaction is tracked and accounted for, something that in the industry can be obscure.”

The luxury real estate startup is something Schrimpff and his co-founders are optimistic about. Kocomo has attracted interest from many eager buyers and investors that understand ocean front properties are limited and in high demand thanks to factors like COVID-19 accelerating plans and the urgency of spending time with family and friends.

Plans for the future include a roster of more affordable and accessible homes for buyers looking for a smarter way to own luxury properties.

The short term forecast for Kocomo: Sunny with a side of investment.

Create your own free org chart today!

Show off your great team with a public org chart. Build a culture of recognition, get more exposure, attract new customers, and highlight existing talent to attract more great talent. Click here to get started for free today.

In this article

The ORG helps

you hire great

candidates

Free to use – try today