- Iterate

- Meet The Team

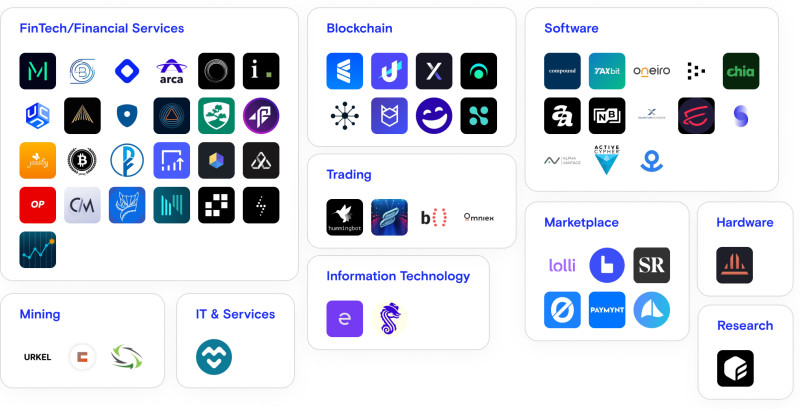

- 50 Early Stage Crypto Companies to Watch in 2022

50 Early Stage Crypto Companies to Watch in 2022

The Org has compiled a list of 50 early-stage cryptocurrency companies based in the United States, ranging from seed to Series D to keep an eye out for in 2022.

For some people, cryptocurrencies might sound like one huge scam, others think that it is a complete joke. Many have placed their life savings in cryptocurrencies and few have also become billionaires.

It might come as no surprise that cryptocurrencies are widely unpredictable. In May this year, the value of Dogecoin, which initially started as a joke, blew up to an astounding $50 billion after Elon Musk tweeted about it and although many still have doubts about the space, blockchain technology is here to stay.

In fact, KPMG’s Pulse of Fintech report shows that investment in blockchain technology and cryptocurrencies had doubled in 2021 in comparison to last year. VC investment in the space has also seen upward trends, with numerous startups raising over $100 million in funding.

Deloitte’s 2021 Global Blockchain Survey shows that more than 80% of financial executives believe that blockchain technology is scalable and has already achieved mainstream adoption and more than 70% believe that if they do not adopt blockchain technology they are likely to lose competitive advantage.

As such, larger institutions are also looking to accept cryptocurrencies, with JPMorgan being the first financial institution to give the green light to its wealth management clients to access cryptocurrency funds in July this year, Insider reported.

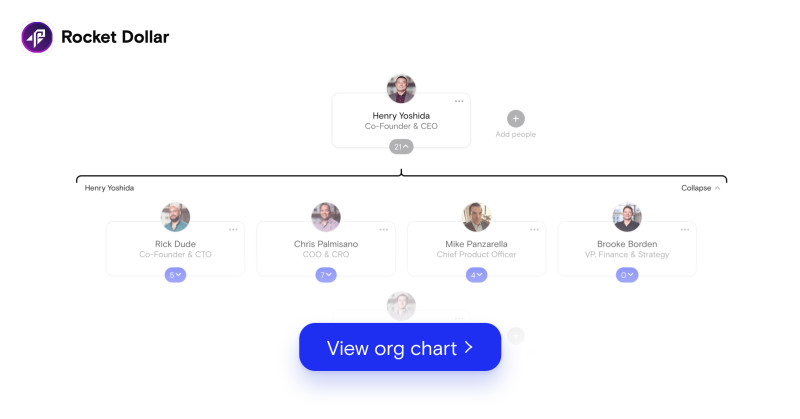

“Institutional adoption has just arrived in the last few years of cryptocurrency. This adoption is another signal of a maturing industry, and institutions or advisors that are not onboard are seeing more demand from their customers to address cryptocurrency seriously,” Brendan Walsh, Business Operations Manager at Rocket Dollar, told The Org.

Rocket Dollar was founded in early 2018 after Thomas Young, one of Rocket Dollar’s co-founders, recognized that there were limited alternatives for asset investments in retirement accounts and wanted to build a company that could allow individuals to invest their retirement savings in assets such as real estate, cryptocurrencies and startups. So far, the company has raised $13.5 million dollars and has 24 employees.

“Many younger investors are forgoing more traditional finance expectations and diversifying their portfolios faster than their parents are. As alternatives and the crypto space keeps growing, it is only natural that some would request it be part of their retirement account.” Walsh said. “The growth in the area of retirement crypto at Rocket Dollar continues to come from a variety of ages and experience levels. This is continued validation that many investors want crypto as a long-term asset class in their portfolios.”

With cryptocurrencies becoming a more common way for investors to earn money quickly, the IRS has also requested investors disclose their cryptocurrency activities on their tax returns. But many people are uncertain about which transactions should be reported, and tax evasion has become a notorious problem in the crypto space.

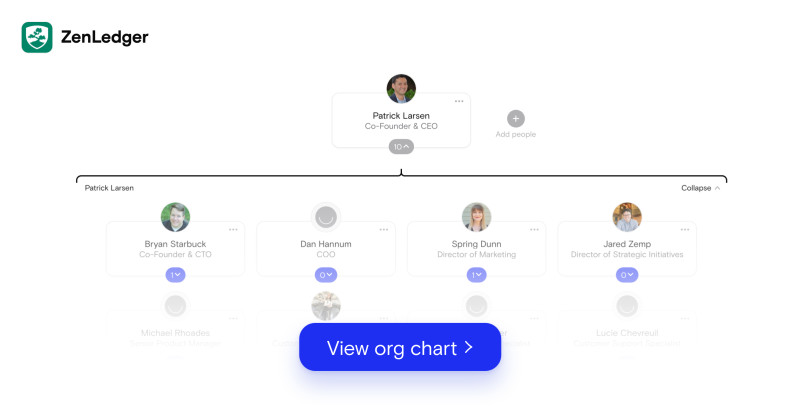

As such, startups such as ZenLedger, which aims to simplify tax preparation for crypto traders have also come into existence.

“With the ongoing tax reporting debate in Congress and the virtual currency question listed at the top of Form 1040, the current administration and the IRS have made it clear that they are taking crypto tax evasion seriously,” Jordan Hiken, Digital Marketing Specialist at ZenLedger, told The Org.

ZenLedger aggregates its users’ transaction information across exchanges, wallets and tokens into one dashboard, making it easier to calculate tax liabilities and prevent tax violations.

“Cryptocurrencies have become a $2.5 trillion market over the past few years, making them one of the fastest-growing asset classes in the world. With increasing regulation and greater sophistication, cryptocurrencies could become integral to the financial ecosystem, but the pace and success of the transition will depend on externalities, such as innovation, new regulations, the securitization of cryptocurrencies, and consumer preferences,” Hiken said.

With blockchain technology continuously evolving and attracting large institutions and individual investors, startups building for the virtual future should not be dismissed.

The Org has compiled a list of 50 early-stage cryptocurrency companies based in the United States, ranging from seed to Series D to keep an eye out for in 2022.

| Logo | Org Chart | Total Funding (Millions) | Series | Team Size |

| ---------- | ---------- | ---------- | ---------- | ---------- |

|

Create your own free org chart today!

Show off your great team with a public org chart. Build a culture of recognition, get more exposure, attract new customers, and highlight existing talent to attract more great talent. Click here to get started for free today.

In this article

The ORG helps

you hire great

candidates

Free to use – try today