- Iterate

- Meet The Team

- In Conversation with Two Startup Founders Closing the Massive Insurance Gap in Africa

In Conversation with Two Startup Founders Closing the Massive Insurance Gap in Africa

Table of contents

The Org spoke to the founders of two insurtech startups — Lami Technologies, which helps Africans access insurance through existing platforms such as banks and telecommunications companies, and Pineapple Insurance, which uses a digital-first, design-led approach to provide insurance products for younger consumers in South Africa.

Lami Technologies

Lami Technologies founder Jihan Abass was on a vacation back home to Nairobi, Kenya when she learned that so few people in her home country had access to some form of insurance products. She was chatting with a waiter who told her that they did not have medical insurance. She was working as a futures trader at that time in London, after completing her MBA at Oxford University.

Abass did some research to better understand why so few people had insurance in the Kenyan market. Her key findings were there was a lack of infrastructure in Kenya to enable service providers to distribute their products. The other issue was a lack of access to markets for the end users, because most people who live primarily in rural areas don’t have insurance brokers. There was very little understanding about the importance of insurance as a means to financial security, particularly for small business owners. “Most people rely on one source of income and are not thinking of ways to protect it, i.e. if you are a truck driver and that truck gets burned, you might have financial difficulty in the end,” Abass told The Org. She founded Lami to fill this need in 2018.

Lami Technologies decided on a B2B go-to market strategy to use with its platform, given how long it would take to close the insurance gap with a B2C model. Its APIs are able to plug into banks, mobile money providers that have an existing customer base through a single integration. Lami also serves as a marketplace for insurance products across different categories for e-logistics, e-commerce and buy-now-pay-later platforms that are looking at various ways to monetize their user base.

Lami raised $1.8 million in 2021 to create strategic growth avenues by acquiring Bluewave Insurance, which gave them a key advantage to distribute micro-insurance through diverse channels, such as USSD, SMS, WhatsApp chatbots and web applications. “We were able to bring on skilled talent through the acquisition where the engineers had a strong actuarial background and great knowledge about insurance distribution in rural areas,” Abass said.

The startup launched an innovative insurance product for e-logistics marketplace, Sendy, whereby drivers can insure their fleet on a once-off basis, rather than being locked into annual insurance premiums. Its aspiration is to be in five markets by the end of 2022. “We are a first mover in the space and so we need to be more agile when it comes to integrating more partners and building an ecosystem that will allow us to be the leader in digital distribution of insurance,” Abass said.

Pineapple Insurance

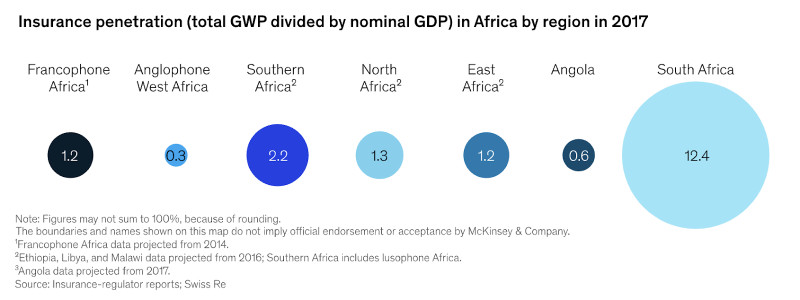

It was at a start-up incubator bootcamp hosted by global insurance company Hannover RE in 2016 were the co-founders of Pineapple Insurance, Matthew Elan Smith, Marnus van Heerden and Ndabenhle Ngulube met, when they were placed in the same team. Elan Smith was working as an actuary at that time for an insurance company, and the trio joined forces to start Pineapple in 2017. While South Africa has the largest market share at 70% of the insurance market in Africa, that penetration is concentrated in a well-insured minority of South Africans, and there are many people who feel insurance products are not within their reach.

“We applied a design thinking approach to identify areas where insurance companies were falling short in South Africa. One was that insurers are making profit from left over from premiums, which creates conflicts of interest. There is also an accessibility gap, to make insurance available online,” Elan Smith told The Org.

Pineapple has embedded innovations that allow customers to upload their pictures of items they want to insure, and the company leverages AI to provide a quote in under 90 minutes. Simplifying the user journey by visually explaining coverage and taking out as much jargon as possible that tends to be prevalent in insurance has been beneficial for Pineapple. The company currently has more than 130,000 clients who are primarily between 25 and 35 years old and has partnered with Old Mutual as its underwriter, which has given Pineapple access to highly skilled people in the insurance industry.This gives investors confidence that Pineapple is underwritten by a reputable player in the market.

Pineapple raised a Series A round of $5.4 million last year, to increase its customer base and to optimize the customer lifetime value. "We are not in the business of raising as much as possible but are more about getting the business to where it needs to be,” Elan Smith said.

Some of the key milestones Pineapple has already reached, include forging an agreement with the U.S. insurer Travelers by white-labeling its technology to assist them with launching a product. “We are very passionate as a team about showcasing the tech talent that South Africa has to offer. The Travelers partnership is a testament to how we can develop the same technology as in Silicon Valley, more affordably to activate the local economy in the process,” Elan Smith said.

Founders File Q&A

What advice would you offer to other budding tech entrepreneurs in Africa?

__Jihan Abass __

- There is no right time to start a company – just do it and figure it out along the way. If there was ever time to start a company, now is the right time to do so given the amount of capital that is being deployed in Africa.

- Hire people with more experience than you in your team to learn from and get a leadership coach who can help you navigate the people management aspects and give you insight on certain challenges along the journey.

__Matthew Elan Smith __

- Use the tools that are available to build MVP’s using low code platforms and test them as soon as possible.

- Find co-founders as it's more valuable to build things together with others and set yourself targets or goals and measure the growth of the business against those.

Get in front of millions of visitors and job seekers.

- Showcase your company culture to a vast community of professionals

- Host your team on a free org chart to keep employees aligned

- Post jobs on our free job platform for high growth startups

The ORG helps

you hire great

candidates

Free to use – try today