- Iterate

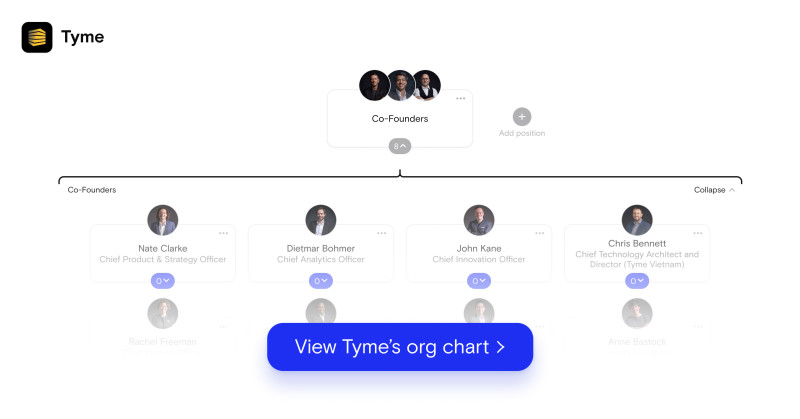

- Meet The Team

- TymeBank's Key Ingredients for Building One of the World's Fastest Growing Digital Banks

TymeBank's Key Ingredients for Building One of the World's Fastest Growing Digital Banks

In 2019, TymeBank was launched in South Africa and it acquired 3 million customers within 25 months of operating, in a market that has a well-established and mature formal retail banking environment. The Org spoke with TymeBank CEO Tauriq Keraan to find out the underlying drivers for the company’s success in becoming one of the world's fastest growing digital banks.

Over the past ten years, there has been steady growth in digital banks globally. Nubank,co-founded by David Vélez in 2013, disrupted the Brazilian banking market and has become the world's largest digital bank with over 40 million customers. In the same year, N26 was established to make banking easier and more transparent, and it now has more than 7 million clients in 25 markets and has said it plans to acquire 100 million customers over the long term.

With 30 years’ experience in banking, Anne Boden started Starling Bank in the U.K. in 2014 to serve as a tech-driven alternative to some of the incumbent banks she had been working for. The bank has over 2 million accounts open and holds a $1.9 billion valuation.

In 2019, TymeBank was launched in South Africa and it acquired 3 million customers within 25 months of operating, in a market that has a well-established and mature formal retail banking environment.

The Org spoke with TymeBank CEO Tauriq Keraan to find out the underlying drivers for the company’s success in becoming one of the world's fastest growing digital banks.

“The idea to build Tyme, the precursor to TymeBank, initially began in 2012 as a project in Deloitte, that was focused on building a mobile banking service for one of its telco clients,” Keraan, who was part of that team, said.

The project could no longer continue within Deloitte and a decision had to be made to either shut it down or spin out the team as a standalone commercial business. In July that year, Tyme (which stands for Take Your Money Everywhere) was launched as a neobanking service. In 2017 Tyme was granted a full banking licence - the first to be issued in South Africa since 1999 and launched as TymeBank in February 2019.

Keeran said the idea behind TymeBank was to build a service for customers that gave a better banking experience, and was of greater value, adding that common frustrations in the traditional market were high costs and poor customer service.

Within two years of operating, TymeBank managed to get a Net Promoter Score (NPS) of 57, while the average NPS for bigger retail banks is only 33. From a fees perspective, the bank is 30% more affordable than the next most affordable bank in the market. As a digital bank, they are able to run a retail operation at a cost base that is significantly less than the large incumbent banks. They are also able to make use of customer data and fully digital processes to deliver simplicity, transparency and convenience to customers.

Key to the bank's purpose is creating a scale retail bank that services the needs of all segments, regardless of their levels of digital literacy. Keraan outlined that while e-commerce is rapidly growing in South Africa it only constitutes about 2% of all retail purchases and that most South Africans still prefer to buy goods in the physical world, with about 60% of all retail transactions being cash.

To build and scale a retail banking service in an emerging economy such as South Africa, TymeBank made a conscious decision to use a hybrid model that leverages all the benefits of being a digital bank as well as the ability to sign up customers in the physical world without building bank branches. It achieved this through a partnership with FMCG retailer, Pick n Pay Group, as South Africa has one of the most concentrated grocery retail sectors in the world. Customers can sign up for a transactional and savings account in under five minutes without any paperwork at the kiosks located in stores. Till points at the supermarkets are used to deposit and withdraw money.

The company’s onboarding process has enabled it to cater to people that would typically be considered private banking clients, as well as those who are social grant recipients. The bank uses open architecture which enables it to integrate third parties without taking on the operational complexity or exposure on its balance sheet, such as enabling short term insurer Hollard to sell policies using its banking platform.

TymeBank’s success of having scaled to serve over 3.4 million clients with personal and business banking products in a short space of time is attributed to its agility. The company is able to fix process inefficiencies as they come up, and in a cost-effective way as there are no legacy issues in its technology stack. The team has done away with manual processes in the bank by leveraging robotic process automation and artificial intelligence. Keraan´s philosophy is that the agility of digital banks is what ultimately allows them to compete head-on with the large older banks. TymeBank was named the third best bank in South Africa by Forbes Magazine in 2021, an award assessed on customer satisfaction, trust, terms and conditions, transparency and digital services. It also earned third place in mobile and internet banking on the SITEisfaction index, ahead of some of the legacy banks. Keraan believes it is the company’s hybrid distribution model and radical transparency around fees and interest earned that makes it stand out from the pack, together with its ability to resonate with customers.

Although the bank has had quite a good run throughout the COVID-19 pandemic, Keraan outlined how it has been a demanding time for the business. TymeBank pivoted its strategy to accommodate the realities of the pandemic, realigned priorities, executed seamlessly against that, continued growing, met financial targets, improved its net promoter scores and brand equity and maintained a good risk posture, he said.

The most notable accomplishment was that of raising a Series B investment of $109 million in February this year. A key investor is JG Summit, one of the largest and more diversified Filipino conglomerates engaged primarily in businesses that serve a growing middle class with rising disposable incomes in the Philippines, Southeast Asia, and Australasia. The investment was co-financed with the U.K. based private equity firm Apis Partners. TymeBank saw this as a strategic opportunity to enter the banking industry in the Philippines, where about 70% of the population remains unbanked.

The successful implementation of the TymeBank model in South Africa has been a testament to how it can be rolled out in other markets. “The Philippines market has many structural similarities to South Africa, and this creates an opportunity to deploy our technology stack, product configuration and hybrid distribution model with a large degree of replicability,” Keraan said.

The bank is operating in a rapidly expanding segment, which, globally, is set to reach $1.6 trillion by 2027. Keraan´s short to medium term aspirations for the bank locally is for it to be amongst the top five retail banks in South Africa by the number of active customers and have one of the highest NPS of any retail bank in the world.

He would like the bank to deliver ROEs in excess of 50% to its shareholders for all the support and backing they have given and he believes this is entirely possible as a digital bank that has good operating leverage. Lastly, he would like customers to say “TymeBank was the bank that helped me reach my potential.”

“We have always been a tightly woven, purpose-led organisation that cares deeply about our people. I think this stood us in good stead going into the pandemic. I too often see organisations behaving well in good times, and poorly in tough times. This is the difference between the personality of a business, and the character of a business. True character is only revealed during times of adversity, not during times of prosperity. I would like to believe that we have shown our true character during this time,” Keraan said.

Time will tell what traditional banks will do to counter the digital banking revolution. What we know is that TymeBank’s model is positioned to be replicated into new territories and chart an upward growth trajectory, with the customer at the heart of its proposition. And that’s not a bad thing at all.

--

The Org is a professional community where transparent companies can show off their team to the world. Join your company here to add yourself to the org chart!

In this article

The ORG helps

you hire great

candidates

Free to use – try today