- Iterate

- Meet The Team

- Australia's Most Exciting Fintechs of 2021

Table of contents

Not the ones to wallow in regret, Australia’s financial sector has undertaken massive steps to turn things around. Driven by technology, the new faces of Australian finance are addressing many of the entrenched issues in the industry.

Airwallex

In some ways, taking a brand global is as simple as a good internet connection. What hasn’t been so simple is the financial side of operating over different countries and currencies.

For years, small and medium sized businesses had been paying an arm and a leg on unfavorable foreign exchange rates, and pulling their hair out trying to manage revenue generated across various countries.

Recognising this as an opportunity for disruption, Melbourne-based Airwallex entered the market in 2015 with a multi-currency wallet aimed at SMEs. Last year, the company officially joined the list of Australian unicorns, with a reported $1.8B valuation.

Among the most exciting prospects for the Aussie fintech is in building the plumbing to support international payments, which is currently dominated by Belgian brand SWIFT.

“To support business growth in this new digital era, Airwallex has invested heavily over the past few years in building a global digital infrastructure and an extensive suite of products that enable businesses to efficiently move and manage their money across borders,” said Jack Zhang, CEO and co-founder of Airwallex.

Zip

If skyrocketing share price is anything to go by, Zip has cemented themselves as one of the most exciting fintechs in Australia right now. Investor’s have heaped into the BNPL sector since the pandemic hit, taking Zip’s stock from its $1.30 low in March last year to $9.50 in February 2021. Not only has the company gained ground from its suite of products, but the strategic purchase of fellow BNPL QuadPay last year has given them access to the coveted U.S. market.

“The momentum we established in 2020 is set to continue in the coming year,” said Matthew Abbott, Director of Corporate Affairs, in an interview with The Org. "Not only have we cemented Zip as one of the fastest growing players in the sector, but strong growth in countries like the U.S., driven by the uptake of QuadPay, means that we are well placed to continue delivering on our mission of becoming the first payment choice everywhere, every day.”

Last year Zip partnered with Visa to bring Tap & Zip, a bona fide competitive product to credit cards that allows consumers to make BNPL purchases through Apple and Google Pay. Like other Zip offerings, consumers pay off in installments without interest.

Afterpay

With their eye-watering interest rates and draconian penalties, credit card companies are about as popular as a rattle snake in a lucky dip — the perfect storm for the recent emergence of by now, pay later.

Unlike credit cards, buy now, pay later (BNPL) brands charge no fees so long as repayments are made on time. Revenue is generated on late payment fees, but consumers are able to carry a balance and are never charged interest on their debt. This has proved very popular for younger consumers who are both debt averse and are spending more online.

Of Australia’s top BNPL performers, Afterpay is head and shoulders above the rest, boasting an incredible $42.2B AUD market cap. In the fourth quarter of 2020, the BNPL saw 20,500 new customers joining a day, which helped their share price go to the moon - more than tripling in the last year ($152 AUD at time of publish).

Much of this rapid growth comes from Afterpay's increasing global footprint. Services are now accessible in more than 40 countries in the world, including recent aggressive expansions in Canada.

Judo Bank

Another outfit benefiting from Australia’s liberalised open banking rules has been Melbourne outfit, Judo Bank.

Less widely known than 86 400, Judo Bank focuses on helping small and medium sized businesses through a digital-only banking system. It started as an alternative lending platform before receiving its full banking license in 2019. Similarly to 86 400, Judo Bank hangs its hat on the low fees and clever online native platform.

Since achieving its banking license, the growth in investment for the neo bank has been meteoric. Last year, it raised $230M a mixture of existing investors and new major institutional investors, hoisting the value of the fledgling company well above $1B and into the rare unicorn club.

“The enormous support we have received from investors will further underpin our mission to transform SME lending in Australia,” said Judo Bank co-founder and co-CEO, David Hornery.

The big bet of SME lending is showing early signs of returns, with a recent report indicating just 2.4% of Australian small and medium sized businesses are on loan deferral. As the long road to economic recovery begins in earnest this year, lending will be a crucial way for the countries to get back on its feet, and Judo Bank is cementing itself as one of the best ways to get that funding. It is backed by the Myer family and was launched in 2018 by Hornery and NAB banker Joseph Healy.

86 400

One of the central issues dogging the Australian banking system has been the “oligopolistic” dominance held by its top four banks. To combat this and provide greater options to consumers, Australia has seen a massive spike in neo banks over the last two years.

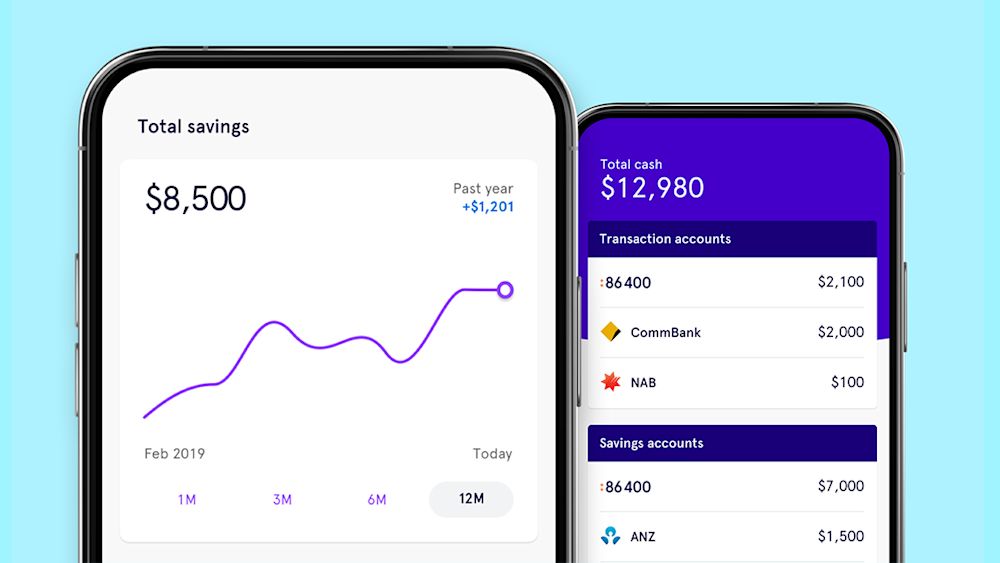

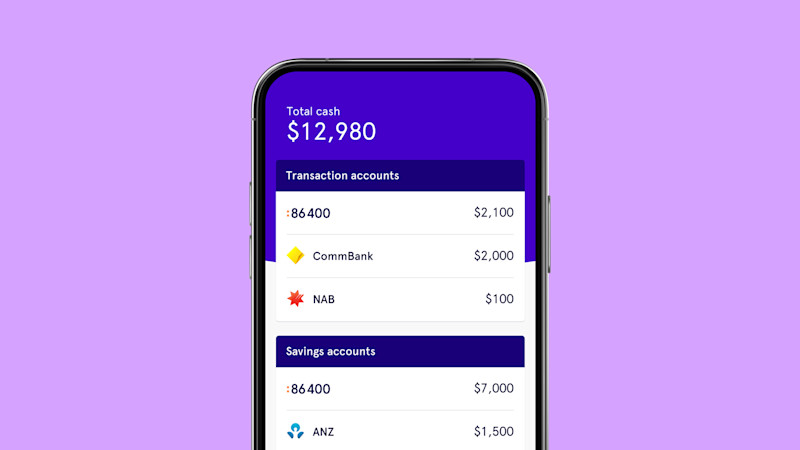

In 2018, 86 400 announced its launch, and later became Australia’s first neobank to receive a full banking licence from APRA, meaning they could function as a deposit-taking bank. They have touted a digital version of the stagnant banking institutions many are familiar with; bringing down overheads by swapping brick and mortar premises for an entirely digital customer experience.

Last week the company announced they would be acquired by the National Australian Bank in a $220M agreement. Despite any blowback for signing a deal with the proverbial devil, it’s worth noting 86 400’s range of offerings, which includes home loans, puts them in a prime position to capitalise on Australia’s new Open Banking push, which allows third parties to access banking data and increases collaboration between financial service providers.

--

The Org is a professional community where transparent companies can show off their team to the world. Join your company here to add yourself to the org chart!

In this article

The ORG helps

you hire great

candidates

Free to use – try today