- Iterate

- Meet The Team

- How Chinese-Based Transsion Became the Top Mobile Phone Seller In Africa

How Chinese-Based Transsion Became the Top Mobile Phone Seller In Africa

Table of contents

The Chinese-based smartphone maker has yet to sell a single phone in China, where their phones are manufactured. Instead, it set its sights on a less-saturated market: Africa's burgeoning demand for affordable and reliable smartphones.

Selling at the right price points for mass market consumers

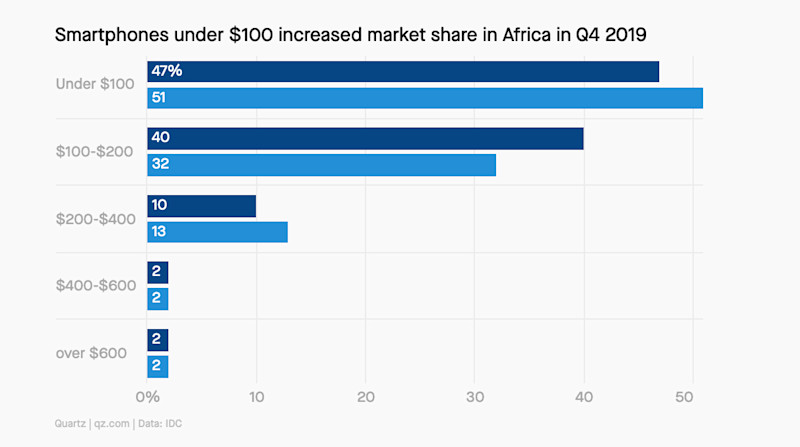

Research indicates that smartphones that sell below $200 in Africa tend to perform extremely well, and as a result over 80% of smartphones shipped to the continent fall within this price range. Cellphones that fall below the $100 mark began to gain traction in Q4 of 2019.

In countries such as Kenya, Ghana and Ethiopia, entry level mobile phones cost on average 69% of a person's monthly income, which is why lower cost phones are in higher demand. Transsion understood this and so its entry level Itel IT 406 retails for about $50, while its top of the range Tecno Camon 16 costs on average $232.

The biggest growth markets in Africa for Transsion have been Nigeria, Egypt and South Africa. The company only made its debut in South Africa in March 2020, where the smartphone market has been heavily dominated by brands such as Samsung, Huawei and Xiaomi.

Customized phone features to meet the needs of African consumers

Transsion pioneered making dual SIM card phones on learning that consumers often have more than two SIM cellphone packages to avoid paying high network fees at a certain time without needing two different phones.

The company worked with technology partners such as Visidon, ArcSoft and SenseTime to develop a camera for the Tecno models that enhances light exposure settings for people with darker skin tones. To combat the impact of frequent power outages — common in some African countries — on the phone's battery life, Transsion worked with Richtek Technology to develop a low-cost battery that charges faster than others in the market, and developed AI driven technologies that optimize power distribution to extend the phone’s battery life.

To expand market share into Ethiopia, Tecno became the first phone brand to offer a keyboard in Amharic and then added Swahili and Hausa keyboards to other Transsion devices.

Invested in localized branding and marketing

To have strong resonance amongst its addressable market, Transsion has allocated big budgets towards billboard advertising in big cities and remote villages on the continent, leading with the Tecno brand.

Strategic endorsements have served the company well, signing on Nigerian Afropop star Wizkid as the brand ambassador for Tecno, and having a multi-year partnership with the English football club Manchester City.

The firm developed its own popular after-sales repair service, Calcare, which operates like Apple Care providing warranty liability for its phones. The three brands have done considerably well in Africa, being featured yearly on the Top 100 Most Admired African Brands list, with Tecno being placed 5th in 2020 ahead of Apple at 6th position.

The company has even tapped into the music streaming market to compete with Apple Music and Spotify by creating Boomplay in 2015, which has managed to attract 62 million users. The platform comes as a default app with a range of smartphones, and is also available on the Google Play and Apple App Stores.

Transsion is also in the venture capital game, backing an Africa-focused venture capital firm in partnership with Gobi called Future Hub, which provides early-stage funding to primarily tech-driven start-ups on the continent.

The company has achieved notable success in replicating its model for scale in Africa, India, Southeast Asia and Latin America. But without a doubt it will face stiff competition from other players that want a share of the African market as smartphone penetration and internet adoption increases.

Mobile operator Orange announced it will be partnering with Google to launch the $30 Sanza smartphone in its 18 operations in Africa and Middle East. But competing on price and additional features alone will not be enough. Those who succeed will be the ones creating mobile devices that serve as tools to solve some of the biggest needs on the continent, those that help people build businesses, find meaningful employment, and use technology to provide education at scale.

--

The Org is a professional community where transparent companies can show off their team to the world. Join your company here to add yourself to the org chart!