- Iterate

- Meet The Team

- Meet the Team Behind Snapdocs, the Startup That's Just Raised $60M to Process Mortgages in the Cloud

Meet the Team Behind Snapdocs, the Startup That's Just Raised $60M to Process Mortgages in the Cloud

Table of contents

Built to help the fragmented housing market run more efficiently, Snapdocs gives real estate professionals the tools to digitally manage the mortgage process, a process typically overburdened by paper documents passing through numerous sets of hands

Digital mortgage closure company Snapdocs has raised $60 million in Series C funding less an year after its Series B round raised $25 million.

Built to help the fragmented housing market run more efficiently, Snapdocs gives real estate professionals the tools to digitally manage the mortgage process, a process typically overburdened by paper documents passing through numerous sets of hands.

The company helps lenders, title and escrow companies, signing services, and notary publics streamline operations to be compliant and efficient by building technology that moves much of their work online, and allows for digital mortgage closure.

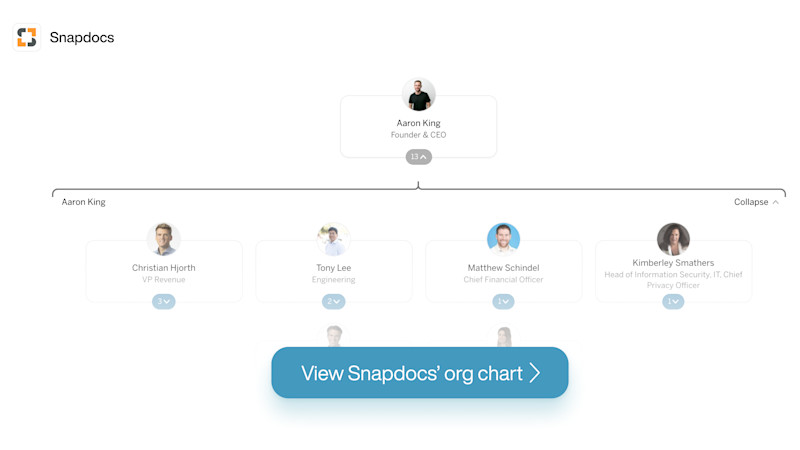

Meet the Snapdocs team

Snapdocs CEO Aaron King said the past six months had been an accelerant for digital transformation, pulling the industry forward at least two to three years.

“A global pandemic resulting in a move to remote work, as well as low interest rates leading to surging home sales and refinancing applications nationwide, has forced the industry to reconcile with its old ways and adopt digital workflows, quickly,” he said.

“The new way is working. For our industry, there’s no going back.”

Wheels in motion

Unlike some startups built to disrupt a market, Snapdocs was built to solve a very real technologically underserved issue.

The team has built a platform in the cloud to store and manage the multitude of documents needed to buy a house, which can be accessed by all the different parties involved remotely.

Anu Hariharan, a partner at YC Continuity who joined Snapdocs board with the latest funding round, said Snapdocs was quickly becoming “the operating system” for mortgage closings.

The Series C was led by YC Continuity, with investment from Sequoia Capital, F-Prime Capital, and Founders Fund, plus new backers DocuSign and Lachy Groom.

Something’s in the water

Despite the size of the market, Snapdocs is one of the few tech startups designed to solve issues with real estate transfers.

Although King won’t discuss the company’s valuation, he said most of the $103 million Snapdocs has raised to date was still sitting in the bank. In October 2019, in its Series B round, Pitchbook data estimated Snapdocs to be worth $200 million.

This year, the startup has seen huge growth in demand for its services, with house sales reaching a 14-year high in August.

In August alone, Snapdocs closed 170,000 house sales on the platform, totaling $50 million in transactions and accounting for 15% of all sales that month in the United States.

The company is on track to close 1.5 million sales this year, doubling what it did in 2019.

Nationally, Snapdocs is being used by 70% of settlement agents and the company says lenders who use the platform typically see more than 80% of hybrid closings successfully eSigned – with closing times shortened to 15 minutes.

In 2019, the company increased revenue by 90% and almost doubled the size of its workforce, opening an office in Denver, Colorado.

Guiding vision

King, who founded the company in 2013, will be the guiding force through Snapdocs’ next stage of growth.

King has been in the industry for more than 20 years. He started out working as a notary when he was 18, and founded the company at 21 when he saw how tech could improve the mortgage process. Snapdocs’ success is testament to his foresight in solving a problem few others were working on.

“Most people have identified this as a tech problem, and a lot of the tech — such as e-signatures — has existed for 20 years, but the fragmentation of real estate is the issue,” he told TechCrunch, predicting the real estate industry would be completely digitized in the next five years.

Snapdocs’ vision to build a software platform that connects all stakeholders and enables a seamless digital close will remain unchanged. “We’re using these unexpected circumstances as an opportunity to accelerate our progress on behalf of our customers.”

With the new investment, he said Snapdocs would grow its team significantly, invest heavily in R&D and introduce more innovation across all of our products.

The team taking Snapdocs to the clouds

At King’s right hand is bound to be Head of Product Briana Ings. Ings has been with the company since 2018, and has played a large part in getting Snapdocs to where it is today.

She said that like retail, real estate was moving towards more consumer control and technology was increasingly impacting the industry. Snapdocs’ platform was the connective tissue uniting all the subindustries of the real estate market in a fast, affordable and transparent way.

Ings said she came to Snapdocs not only to build the product, but also the company. “Aaron has a strong vision, but he’s open to letting others help execute,” she said. “As a product person, that balance was really important to me.”

Christian Hjorth, VP Revenue, will also no doubt play a leading role in the company’s development. Hjorth has been with Snapdocs since January 2018, having previously worked at Folloze, Tradeshift Network and Salesforce.

Also steering the way will likely be Engineering Lead Tony Lee. Lee, who joined Snapdocs in January, has years of engineering experience – having worked at Yahoo, NASA and Zendesk. Most recently, Lee led the application engineering team at Dropbox through the platform’s redesign.

--

The Org is a professional community where transparent companies can show off their team to the world. Join your company here to add yourself to the org chart!

In this article

The ORG helps

you hire great

candidates

Free to use – try today