- Iterate

- Meet The Team

- The Flourishing French VC Ecosystem Has Successfully Survived 2020

The Flourishing French VC Ecosystem Has Successfully Survived 2020

Table of contents

Were French investors less risk-taker compared to usual given the worldwide economic slow down? Was 2020 a good or a bad year for VCs in France?

Before 2020 and the global COVID-19 pandemic, the French tech ecosystem had been on an upward trend for years. Benefitting from a nation-wide impulse towards an easier access to entrepreneurship over the past decade, the country had built a strong network of entrepreneurs, investors and talent, accumulated experience and business wisdom from a new generation of successful startups, and developed public and private resources to educate and support the next generation of CEOs.

In 2019, France had the fourth-most unicorns in Europe, 13, finishing behind the UK (75 unicorns), Germany (30), and the Netherlands (15). When it comes to the total economic value created since 2013, Paris was a top 5 city in Europe in 2019 with 18Bn€ ($22Bn), behind London (129Bn€ / $156Bn), Stockholm (47Bn€ / $57Bn), Amsterdam (36Bn€ / $44Bn) and Berlin (29Bn€ / $35Bn).

Then in 2020, flights stopped, a new culture of remote work emerged, and within a few weeks, the business world had to adapt to a new paradigm. How did this affect the rise of the French tech ecosystem? Looking at the VC landscape can give a few insights. Indeed, investments got directly impacted by national and international travel bans as investors, whose primary day-to-day mission consists of meeting entrepreneurs face-to-face to review investment opportunities, were forced to shift to conference calls only. Were French investors less risk-taker compared to usual given the worldwide economic slow down? Was 2020 a good or a bad year for VCs in France?

The booming startup and tech scene in France pushed for a growing demand for VC money

Looking back at the last decade, it took many public and private initiatives for the French tech ecosystem to emerge as a strong competitor in the European market. Since the early 2010’s, many new players and initiatives led to an increased appeal of the French scene: The Family (an accelerator founded in Paris in 2013), the BPI (short for Banque Publique d’Investissement, created in 2012 to be the armed wing of the government to fund entrepreneurship and innovation), VivaTech (a global tech conference created in 2016 which welcomed 100,000 attendees during its 2019 edition), Station F (the biggest incubator in the world that opened the doors of its 34,000 m2 Parisian facility in 2017), and the French Tech initiative. These were all critical to the boom of the French tech scene and the increasing number of VC firms in France. More quality startups meant more capital needed. Those initiatives led to investments in notable French startups such as the search tool Algolia (The Family), the VTC startup Heetch (The Family), the analytics platform ContentSquare (BPI), and the medical appointments platform Doctolib (BPI).

Today, France has secured a strong position among the most active VC investment markets in Europe, along with neighbors UK and Germany. Per a report of Thomson Reuters, a total of 5.03Bn€ ($6Bn) was invested in startups in 2019 in France, for a total of 736 investments, which represents an increase of 39% in value and 14% in volume compared to 2018.

In 2019, there were 296 VC funds in France, and per Pitchbook, the most active firms per number of deals were:

- Kima Ventures (453)

- Partech Partners (223)

- Idinvest Partners (173)

- Alven Capital Partners (107)

- Seventure Partners (97)

- AngelSquare (95)

- Ventech (91)

- Sofinnova Partners (82)

- 360 Capital Partners (76)

- XAnge Private Equity (71)

- Newfund (65)

At the European scale, only one French fund made it to Dealroom’s global top 10 seed stage investors in Europe: Agoranov. Two appear in the respective series A lists: Index Ventures, an English fund with an office in Paris, and Indinvest, which is Paris-based.

French VC firms are still going strong in 2020

On the VC side, to meet the demand of this growing number of startups, firms themselves had to raise more funding to access the investment opportunities not only in France, but also in Europe and worldwide as more and more firms decided to open their funds to foreign startups. In 2018 only, VCs in France raised nearly 2.2Bn€ ($2.6Bn) across 12 funds, a significant jump from the 832M€ ($997M) raised across 25 funds in 2014.

In addition, foreign investors provided 49% of the funds in 2019 compared to an average of 40% in the first quarters of 2009 to 2018. Foreign investors were less active in French VC deals in 2020 compared to 2019, and the overall downward trend can be explained by the complexity of not being able to travel while reviewing deals remotely. In Q4 2019, the UK, the U.S., and Europe (excluding UK and Germany) all respectively invested in more than 10% of the deals in France, a number that went to less than 10% in Q2 2020. Thus, French VC benefited from the pandemic and likely had less international competition when it came to investing in local startups.

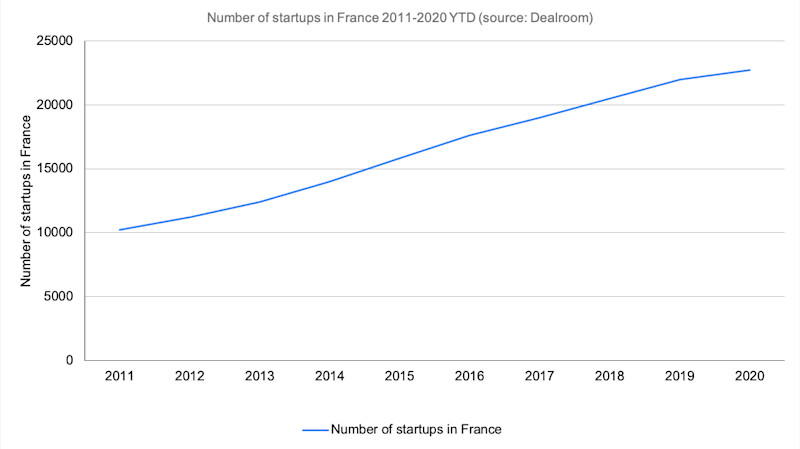

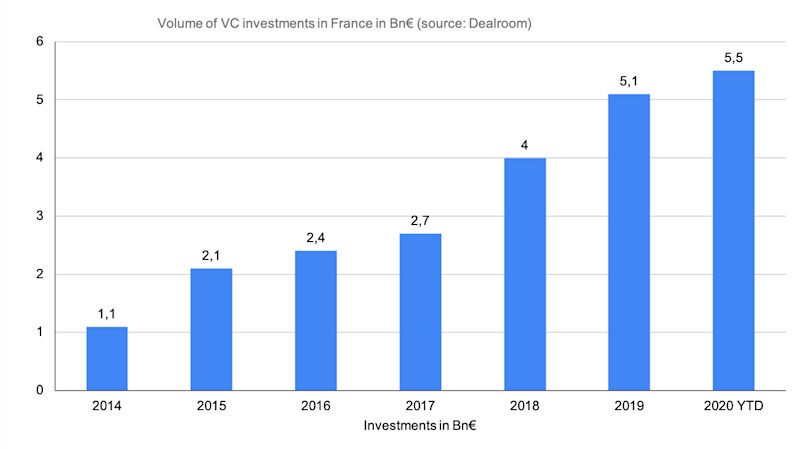

Regarding the number of startups existing in France, the impact of the pandemic can’t be perceived yet, as no decline can be observed as of today per the graph above. Is that the case for VC funding though? The answer is yes: 2020 remains the strongest year ever in terms of volume of VC investments. Going further, in just five years, the total volume of VC investment in France has been multiplied by 5, going from 1.1Bn€ ($1.3Bn) to 5.5Bn€ ($6.6Bn) in 2020 (YTD).

More specifically, the first quarter of 2020 was quite good in terms of VC deals in France: there were close to 70 deals in January for a total of 798M€ ($967M) invested, and with the lockdown happening in March we saw less than 20 deals for 169M€ ($205M) invested in total, a low point. Nevertheless, the performance of April, which was the second month of confinement in France, was surprisingly high, with around 40 deals for 388M€ ($470M) invested. In total, there were 127 funding rounds in Q2 2020 for a total value of 1.1Bn€ ($1.3Bn) in total deal value. The biggest funding rounds were for Contentsquare (175M€ / $212M), BackMarket (110M€ / $133M), Swile (70M€ / $85M), Aircall (60M€ / $73M) and Vestiaire Collective (59M€ / $71M).

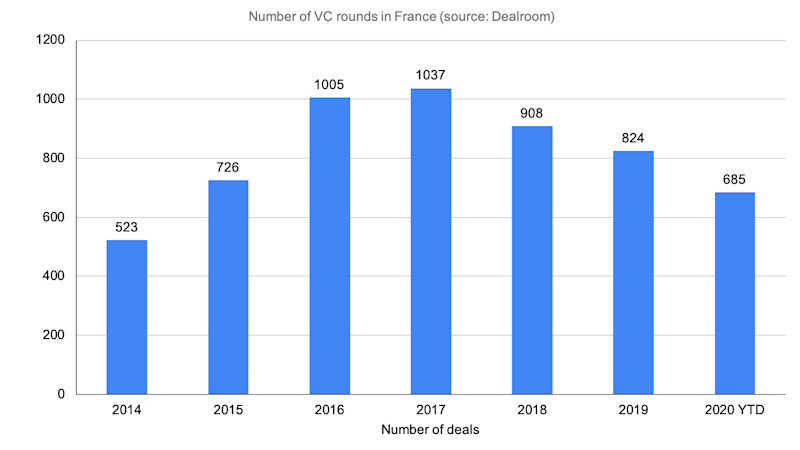

There is no sign of investment slowing down in 2020 and the new year to come. But if the volume is still going up, does that mean that the COVID-19 outbreak hasn’t impacted the French funding landscape at all? Not necessarily. While there was more funding available to startups, as of today, there was a 17% drop in the number of VC rounds done between 2019 and 2020, going from 824 to 685 (YTD). It can be therefore inferred that the current trend in the French VC landscape is fewer investments but bigger rounds overall.

Indeed, the average investment in 2019 had increased from 5.5M€ ($6.7M) to 6.8M€ ($8.2M), up 19% compared to 2018. In particular, the most active capital raising tiers were:

- Between 5M€ and 10M€ (an increase of 62% in value compared to 2018)

- Between 20M€ and 50M€ (44% increase)

- More than 50M€ (73% increase)

- There were four investments exceeding 100M€ ($121M), totalling 576M€

Public initiatives have reshaped the VC landscape

BPI, the French public investment bank created in 2012 to boost the national ecosystem and provide, has been a solid pipeline of funding for startups. Its particularity resides in the fact that 50% is state-owned and 50% is owned by the French financing public authority (Caisse des dépôts et consignations, a French public sector financial institution that is part of the government institutions, under the control of the Parliament, and often described as the "investment arm" of the French State). It has played a major role in supporting French entrepreneurs by investing 191M€ ($231M) between 2016 and 2018. In January 2020, it also launched a plan to support deeptech startups, and 380M€ ($460M) was invested in only one month.

Various tax reforms have also made it easier for individuals to invest in startups: French residents can deduct 18% of the amount subscribed to the share capital of startups from their income tax, provided they commit to hold the shares received for at least five years. Another tax measure allows companies operating in France to amortise their subscriptions to the share capital of innovative SMEs (or to certain investment funds meeting certain investment quotas in innovative SMEs) over a five year period by deducting one-fifth of the investment from the company's annual income). This led to an increase of CVC funds: many funds were launched between 2016 and 2018, such as PSA Ventures (100M€ / $121M) and LVMH Luxury Ventures (50M€ / $61M).

How strong is the exit performance of French VCs?

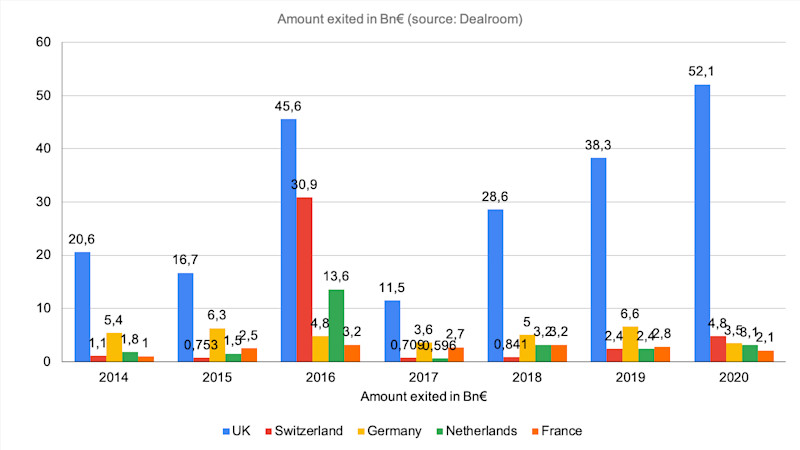

In regard to exits, though, France’s VC performance appears weak compared to its European counterparts and to its number of deals and volumes invested.

February 2020 saw around 20 exits for a total value of 774M€ ($937M), and the second quarter of 2020 was the weakest quarter of exit value since Q1 2018 per Avolta Partners. The biggest exit in Q2 2020 was Shine which was acquired by the bank Société Générale for around 100M€ ($121M). Overall, 45 exits happened in Q2 2020 for a total of 176M€ ($213M) in total deal value. The tech exit median deal value was also overall at the lowest point in Q2 2020 in comparison to all previous quarters since Q1 2018 (22M€ / $27M in Q1 2018 versus 11.4M€ / $13.8M in Q2 2020). Lastly, most exits happened because of acquisitions by French companies (75%), and accounted for around 90% of total exit value. This overall exit performance could be stronger if more French startups were to become attractive acquisition targets for international corporations such as the GAFA.

Overall, France’s VC ecosystem seems to be ascending in the European tech market. While 2020 could have slowed down this soar, French venture capitalists have proved that they had strong foundations to face a global crisis, which foreshadows a great 2021 year to come.

--

The Org is a professional community where transparent companies can show off their team to the world. Join your company here to add yourself to the org chart!

In this article

The ORG helps

you hire great

candidates

Free to use – try today