- Iterate

- Meet The Team

- The Startups Making High-Priced Wine, Art, Cars, and Collectables Part of Everyone's Portfolios

The Startups Making High-Priced Wine, Art, Cars, and Collectables Part of Everyone's Portfolios

Table of contents

In a time when investors are flocking to digital assets like cryptocurrencies and NFTs, who are the alternative investment startups giving people the chance to invest in tangible assets like art, wine, and collectibles?

Rally

Rally got its start in 2017 as Rally Road with a focus on vintage cars. The company has since opened its platform to a wider array of assets like dinosaur bones or a signed, first-edition copy of “African Game Trails: An Account of the African Wanderings of an American Hunter Naturalist” by Theodore Roosevelt. The company, led by CEO George Leimer, offers equity shares in assets like these for as little as $50. Rally raised $17 million in funding in September 2020 bringing the total raised the alternative investment startup to $27 million.

Rares

In much the same way that Rally has brought cars and collectibles into the portfolios of everyday investors, Rares is making high-priced sneakers the next big investment trend. The startup first broke onto the scene in April 2020 and offers sneakerheads a stake in high-profile and high-value footwear. The company recently made a name for itself by acquiring Kanye West’s prototype Yeezy sneakers that he wore to the 2008 Grammy Awards for $1.8 million.

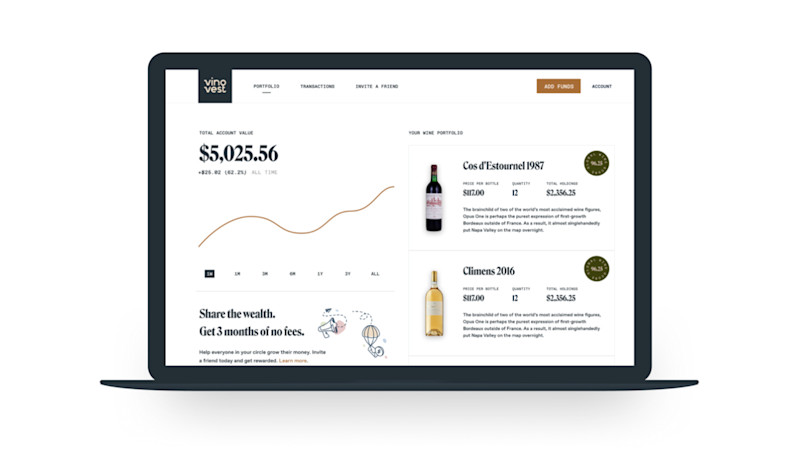

Vinovest

Wine is one of the worlds oldest luxuary asset classes and is still used to store wealth when it isn't being paired with a good meal. In fact, in the past 30 years, wine has outperformed the S&P 500 and even managed withstand the 2008 financial crisis. Vinovest has been helping the average investor add wine to their portfolio since its inception and has even created the Vinovest 100 Index is a proprietary index that tracks the fine wine market. The index’s components include wine prices from major regions such as Bordeaux, Burgundy, Champagne, Rhone, Tuscany, Piedmont, California, Australia, Spain, Portugal, and others.

Otis

Otis calls itself “the stock market for culture” and just like other entries on this list allows users to auy and sell shares of collectibles, sneakers, and art. Otis uses a combination of quantitative analysis and industry expertise to curate a collection of high-quality, culturally significant assets that it believes will appreciate in value. Some of the company’s current offerings are a 2003 Lebron James rookie card, which users can scoop up for $10 per share upon its IPO, as well as artwork by Banksy. The company also includes extensive research and financial analysis on each of the assets it acquires, allowing potential invetsors to do their own homework.

--

The Org is a professional community where transparent companies can show off their team to the world. Join your company here to add yourself to the org chart!