- Iterate

- Meet The Team

- How French People Dine in a Post-COVID Era

How French People Dine in a Post-COVID Era

Table of contents

The pandemic has forced people worldwide to adopt new habits around food, from grocery shopping to cooking to eating. The Org looked into the French foodtech landscape to see which startups have gained traction over the past few years -- reaching millions in revenues or users -- and for whom the pandemic might have been a blessing in disguise.

The pandemic has forced people worldwide to adopt new habits around food, from grocery shopping to cooking to eating.

In France, those abrupt lifestyle changes, which started with the closure of restaurants and mandatory remote work, threatened not only the hotel and restaurant industries, which represent 8% of GDP, but also the traditional French eating art-de-vivre which relies on pleasure and conviviality.

According to a recent study for the Fondation Nestlé, a meal is first and foremost a moment of pleasure for 58% of the respondents, and 79% of people questioned have dinner with someone else during the week.

Although the public health crisis has changed the way we eat, food still remains an important part of the French way of life: 47% of French people said they were cooking more than they used to, and that number jumps to 60% for the 18 to 34-year-olds. The COVID crisis also led to a general enlightenment about the nature and origin of the food French people have on their plates: 70% of respondents said that eating healthy had become a priority after confinement.

Therefore there are plenty of opportunities when it comes to foodtech, and investors' appetite for food businesses hasn't slowed down.

Indeed, 2,7Bn€ ($3,3B) was invested in foodtech startups in Europe in 2020, the same amount as 2019, a real tour de force for the industry.

More specifically in France, some 600M€ ($724M) was invested in 2020, a 50% leap from the 400M€ ($483M) spent in 2019, making France the country with the second-highest level of investments in foodtech in 2020 after the U.K. (634M€/$765M). In a positive sign for the French food startup scene, 53% of investments went to companies at the pre-seed or seed stage, versus 30% in series A.

The Org looked into the French foodtech landscape to see which startups have gained traction over the past few years -- reaching millions in revenues or users -- and for whom the pandemic might have been a blessing in disguise.

Despite slow adoption, food delivery proves popular

In a few weeks, France’s 200,000 restaurants will finally be able to welcome clients after being either fully closed or open for pick-up or delivery only for six months. Despite the good news, it is still unclear when and how restaurants will open - the government is yet to communicate dates and conditions, adding to the inescapable fear of bankruptcy amongst many restaurant owners.

Last November, among the 6,600 food businesses polled by unions from the hotel and restaurant industries, 65.8% said they were afraid of shutting down in 2021. While there is no official number yet, the next few months will be decisive.

Getting a meal delivered to one’s doorstep is not yet a part of the French way of life. French people love restaurants and the dining experience - it's said the first "restaurant", in its modern meaning, was opened in Paris in 1765. It's not surprising then that they're taking their time to adopt food delivery services: in 2019, food delivery only represented 5% of the food market.

This slow percentage can be partially explained by delivery services only being available in the 15 biggest agglomerations of the country.

Nevertheless, COVID-19 helped with adoption: the penetration rate of food delivery services went from 40% to 46% in 2020, and now 7 of 10 orders are made on delivery platforms, versus 1 out of 2 in 2019.

Not only did those services recruit 10% more new users but, overall, clients today are more loyal: more than half order at least once a week, versus one out of three in 2019.

Those results are sturdy knowing the heavy constraints currently imposed on restaurants as people can't pick up their order themselves after curfew (6 pm for a long time, now 7 pm) and can't order past 9:30 pm, consequently limiting the number of customers willing to order online.

While the 18 to 24-year-olds make up the main user base of the services (with eight out of 10 using food delivery services), the penetration rate amongst 35 to 44-year-olds grew by 10 points in 2020. French people of all ages are being seduced by the convenience.

The pandemic also cast light on people's taste preferences.

Pizzas and burgers were ordered by 78% and 58% of food delivery users respectively. Broadly speaking, Italian and Asian food came out of 2020 as the great winners. During the first confinement of early 2020, one of three orders at Just Eat, the European leader, was an Italian meal, and Deliveroo noticed a 1200% surge increase in bò bún deliveries in Marseille, a city on the Atlantic coast.

Employees readjusted to the closure of corporate canteens

New trends coupled with the effects of the pandemic have created opportunities to feed hundreds of thousands of employees who can't access their office canteen anymore.

Traditional players such as Elior, a French multinational company specialized in contract catering and services, have faced hurdles and had to adjust to the new reality. The company, which recently said it would cut 1,888 jobs, announced this month it had acquired Nestor for an undisclosed amount. The cash-positive food startup delivers a full menu (starter-main-dessert) exclusively from fresh and seasonal products.

Popchef -- a startup founded by Briac Lescure and François Raynayd de Fitte -- offers a canteen service, and it recently developed Popchef Minute, a click and collect service allowing employees to order their meals online and to pick them the following day after noon.

Before the pandemic, 50% of the companies in contact with Popchef were interested in this service versus 90% now. Popchef, which now counts 4,000 clients, has also made a step forward in sustainability by working with Pyxo to test eco-responsible tableware.

France has also seen numerous dark kitchens emerge, especially in Paris. The dark kitchen business model allows a platform to cook and deliver fresh meals prepared in kitchens of their own that also serve as distribution centers, removing costs and operational frictions that come with managing a storefront or delivering a restaurant meal. Uber Eats is currently working with more than 180 of them in France, and Deliveroo opened three dark kitchens of their own in the country last year (in addition to adding some 3,000 new restaurants in its network).

New dark kitchen players are launching too. Not So Dark was founded in 2019 by Clément Benoit, who co-founded the pioneering delivery service Resto before launching last-mile delivery platform Stuart in 2016. Not So Dark raised a massive first 20M€-round ($24M) this February to grow its network with some additional 30 dark kitchens and 20 virtual brands. The startup was previously running nine dark kitchens in Paris, Nice, Bordeaux and Barcelona, and seven virtual restaurant brands. It now counts more than 150 employees reaching 1M€ ($1,2M) in monthly revenues.

Home cooking drives the next gen of food startups

With the growth in home cooking, there has been an increasing need for fresh grocery delivery services. Meal delivery startup Frichti, which was co-founded by Julia Bejaoui, said that its revenues multiplied by three in 2020 and that it added 600 references to its catalog of 400 items to meet the demand.

It’s a similar story for La Belle Vie, a grocery marketplace offering delivery services launched in 2015 by Paul Lê. The startup has reached 4M€ ($4,8M) in monthly revenues during the COVID crisis with a 400% monthly growth, far above its usual 100% growth.

Cooking more also means finding more recipe ideas. There to smoothen the process is JOW, a startup founded in 2017 by Antoine Maillard, Brice Audrain and Jacques-Edouard Sabatier. Through its app, JOW offers free simple recipes based on a set of criteria (number of people, allergies or food restrictions, kitchen gear...) and then automatically fills the user's cart with the necessary ingredients. Customers then select the store they want for delivery.

The company, based between Paris and New York, has raised almost 8M€ ($9,6M) to date from e.ventures, Kima Ventures and Stride.VC, among others.

It goes without saying that food media has also provided the needed panacea for those eager to learn how to cook.

TV show Top Chef, which invites famous chefs such as Michelin-starred Hélène Darroze, Paul Pairet, or Michel Sarran as jury members, first launched in 2010 and is now broadcasting its eleventh season. More than 3 million viewers have tuned in every week since the season started last February. But this audience number pales in comparison with Chefclub’s figures.

The startup, which has designed a mobile app with ingredient lists and easy-to-follow recipes and videos, has reached the impressive number of more than one billion views per month and 100 million global users, including 10 million French subscribers. It’s easy to understand why the group SEB, a French consortium that produces small appliances and the world's largest manufacturer of cookware, has invested in the startup’s latest 14M€ ($16,9M) financing round.

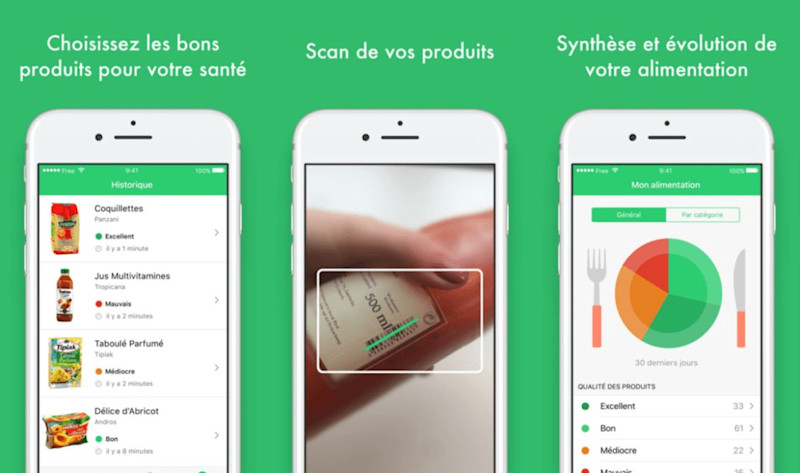

Picking the right ingredients to cook can be trickier than it seems though. Labels on food packaging have multiplied, nutrition information is hard to read and the list of ingredients complex to decipher. Choosing healthy ingredients without too many additives, or too much sugar, fat or salt, can be a supermarket obstacle course -- even online. That’s why 12.5 million French people have downloaded Yuka, a mobile app allowing users to scan products to get easy-to-digest nutritional information in a glimpse, as well as a global "healthy'" grade.

Despite all the impediments of 2020, the French foodtech has never been as strong as it is today. And even though French people have been made to still wait for the now imminent re-opening of the restaurants, their love affair with food has not slowed down.

--

The Org is a professional community where transparent companies can show off their team to the world. Join your company here to add yourself to the org chart!

In this article

The ORG helps

you hire great

candidates

Free to use – try today