- Iterate

- Meet The Team

- The Top 10 Chinese Startups You Should Know About in 2020

The Top 10 Chinese Startups You Should Know About in 2020

Table of contents

China has a booming startup ecosystem measured by the amount of capital raised, and the number of startups, unicorns and exits. The startups in our list range from those making breakthroughs in artificial intelligence to companies using robotics to automate logistics to businesses innovating in the social media sector.

1. Pony.ai

Pony.ai was founded in 2016 by former Baidu autonomous driving sector leader James Peng, and Lou Tiancheng, a 10-year medalist of the TopCoder competitions and 2-time champion of the global programming competition Google Code Jam. This company has been a superstar since its beginning. Not only does it have a stellar founding team with almost all of the members receiving advanced degrees from top universities, the company has also been embraced by top-tier investors, including Sequoia Capital China, Eight Roads (Fidelity International Limited’s investment arm) and IDG Capital.

Pony.ai positions itself as the provider of the best technology in autonomous driving. The company rolled out China’s first fully self-driving fleet of vehicles in 2018, and became the first startup to secure a license to test autonomous vehicles in Beijing. In May, Pony.ai announced that it nabbed licenses to test passenger-carrying autonomous vehicles in China’s capital, an important next step towards broader commercialization of driverless cars.

Last November, Pony.ai was the first company to launch a public-facing robotaxi service in California in collaboration with Hyundai and ride-sharing company Via. This is in addition to Pony.ai’s internal employee robotaxi service, called PonyPilot, located at its headquarters in Fremont, CA. The company exceeded 1.5 million autonomous kilometers (or 932,056 miles) in 2019.

Investors’ appetite for autonomous vehicles remains strong with Pony.ai closing a $462M Series B funding round this February at a valuation of $3 billion led by Toyota. Pony.ai’s relationship with Toyota dates back to 2019 when the companies partnered on autonomous driving pilots in China using Pony.ai’s technology and Toyota’s vehicles.

2. Geek+ Technology

Geek+, a global technology company specializing in smart logistics, is a rising star in China’s movement to boost automation and efficiency in all labor-intensive industries. Utilizing advanced robotics and artificial intelligence technology, the company offers solutions for warehouse and factory operations by solving problems in speed, product diversification, same-day delivery and safety.

Geek+ was founded in 2015 by Yong Zheng, Hongbo Li, Kai Liu, and Xi Chen to address the complex production and logistics challenges faced by warehouse and manufacturing operators amid the rise of e-commerce. The company’s smart logistics systems serve a wide range of industries with customers like Nike, Dell, DHL and Toyota. More than 10,000 logistics robots have been deployed by the company for a new generation of automated warehouses.

In February, Geek+ launched its U.S. operations establishing an office in San Diego. The company now has over 800 employees and is headquartered in Beijing, with offices in Germany, Japan, Hong Kong, Singapore, the U.K. and the U.S.

The expected strong growth potential in the robotics industry has led to plenty of funding from investors. Geek+ raised a $150M Series C1 round in 2019 led by GGV Capital, with participation from D1 Capital Partners, and Warburg Pincus. This follows the company’s $150M Series B round in November 2018 led by Warburg Pincus.

3. Perfect Diary

Digital-beauty brand Perfect Diary, which was founded in 2017 by former P&G veteran and Harvard business school graduate Huang Jinfeng, is the fastest-growing cosmetic brand in China. By adopting various direct-to-consumer channels, the brand delivers affordable quality cosmetics that reflect international trends in cosmetics and fashion, and has quickly become the No. 1 Chinese cosmetic brand.

For many years, almost all of China’s cosmetic market belonged to foreign brands. China's own brands have always been perceived as being inferior in quality and old-fashioned. However, Perfect Diary managed to break the mode by launching a full range of makeup products that are both fashionable and similar in quality to some of the top international brands.

Speed to market propelled by massive social media buzz and innovative marketing tactics have been the defining hallmarks of Perfect Diary, as it achieved exponential growth in only two years since its founding. The company just launched a global website in April, which is viewed as a move to expand overseas. This will also make Perfect Diary the first cosmetics company from China to go abroad.

Guangzhou-based Yatsen, the parent company of Perfect Diary, raised $100M in April at a reported valuation of $2 billion led by Tiger Global Management, which has also invested in New York-based digital beauty brand Glossier. Perfect Diary achieved unicorn status last year in a funding round backed by top VC firms that included Hillhouse Capital and Sequoia Capital.

4. Agora.io

Agora.io aims to revolutionize how people interact globally. The company offers a real-time engagement platform that allows developers to easily embed voice, video and live interactive broadcasting APIs into any mobile, web or desktop application. The company’s industry-leading real-time communication network powers more than 40+ billion minutes of live communications per month.

The company was founded in Shanghai in 2014 by Zhao Bin, previously a founding engineer at WebEx (acquired by Cisco in 2007) and former CTO of Chinese video-streaming giant YY.

With offices in Shanghai and Santa Clara, Agora.io has a global footprint serving both large and small companies, including many of the well-known names in the world of online entertainment. It is the most widely used Communications-Platform-as-a-Service around the world for companies in industries ranging from gaming, social and e-commerce to education, healthcare and more.

Agora.io is reportedly planning a U.S. initial public offering after previously raising a $70M Series C funding round in 2018 led by Coatue Management, a New York tech-focused hedge fund known for its investments in Uber, Snap, Lyft and Grab, among others. Existing investors SIG, Morningside Capital and Shunwei Capital also participated in the round.

5. Ximalaya

Ximalaya FM, or Ximalaya, is the biggest audio platform in China, and even the world in terms of total number of users. With content covering a wide range of audio genres, including audio books, podcasts, training seminars, talk shows and audio dramas, Ximalaya attracts more than 600M users in China.

The company is also expanding into other regions of the world, and in early 2019, it established a U.S. foothold through a San Francisco-based podcasting venture called Himalaya.

Founded in 2012 by serial entrepreneurs Yu Jianjun and Chen Xiaoyu, Shanghai-based Ximalaya rose to the No. 1 position in China’s competitive audio platform landscape with its quality content and strong growth trajectory. But more importantly, it came up with a creative revenue model whereby millions of people in China are willing to pay to listen to various types of content from Ximalaya. The company says that it earns more from user fees than ad revenue. In contrast to music streaming services, the company has a broader range of audio content, which makes it hard to say whether Ximalaya is more like an "Alibaba in audio content" or a "Spotify in all genres.”

Ximalaya has closed several rounds of funding, including a $460M round in 2018 from top-tier investors such as Primavera Capital Group, Tencent, General Atlantic and Goldman Sachs. The company is reportedly valued at more than $3 billion and considering an initial public offering in the U.S. this year.

6. Insta360

Following a trend set by world-leading commercial drone maker DJI, Chinese hardware combining innovative technology with modern design has been embraced by consumers from all over the world. Insta360, which was founded in 2015 by Liu Jingkang and Chen Jinrao, is one of the pioneers of making 360-degree cameras and VR streaming equipment. Insta360 cameras empower creators in over 100 countries, including the U.S. which is the company’s second largest market after China.

The company’s original product was a 360-degree camera, hence the brand name, which Liu started producing when he saw a gap in the market for compact, consumer-friendly cameras that could shoot high-definition 360-degree footage.

Today, Insta360 offers a wide range of products from action cameras for sports lovers to smartphone accessories that can turn an iPhone into a 360-degree camera to professional 3D broadcasting tools. The Shenzhen, Guangdong-based company manages to stay ahead of its competitors by moving faster and adopting bold, innovative approaches in its products.

In April, Insta360 closed a Series D round of funding with Chinese investors led by Citic Securities after raising $30M in 2019. The company is reportedly eyeing a potential initial pubic offering in China this year.

7. Shein

Shein is China’s biggest e-commerce fashion retailer in the overseas market. Headquartered in Nanjing, Jinagsu, the online fashion retailer went from being a dark horse to a leader in cross-border e-commerce worldwide with sales of $2B in 2019.

Born out of the Sheinside brand in 2008, the Nanjing entity registered in 2014 and now operates its business in over 200 countries and regions. The company runs several direct-to-consumer brands through its independent websites, including Shein and Romwe, together with several apps.

Shein targets mostly young female customers with more than 10,000 shoppable items, but also has men's and children's apparel, and home goods. Leveraging the strong supply chain in China’s garment industry, Shein provides customers all over the world with the latest fashion at an affordable price, so it's sometimes referred to as the "Zara online of China."

The company’s founder and CEO, Xu Yangtian, a 30-something entrepreneur, first started the company exporting wedding dresses. The company has completed several rounds of funding with the most recent one in 2019, reportedly a $500M Series D round.

8. AIG (Asia Innovations Group)

AIG (Asia Innovations Group), a leading mobile social entertainment platform, was founded in 2013 by Andy Tian, a former Zynga China general manager and Google China executive, and Ouyang Yun, previously a Tencent strategist.

The company has been able to capitalize on the live entertainment boom in China, while also expanding cross-border with a mission to bring the best Chinese next generation mobile products, business models and technologies across social and online entertainment to the international market.

AIG has launched several entertainment apps around the globe gaining a foothold in Asia, the Middle East, North Africa, Europe and North America. These apps include Uplive, Suprefans and L'amour, and encompass a range of short video, live streaming and dating formats. Life seems to be overwhelmingly fun in the world of AIG’s apps, as they cover almost all of the primary functions of online entertainment. Today, AIG’s app matrix has more than 100M users and more than 30M monthly active users from over 150 countries.

The company is headquartered in Beijing and has offices in 12 cities around the world, including Los Angeles, Tokyo, Jakarta and Cairo, and has raised several rounds of funding from leading global VCs such as Kleiner Perkins, Ventech and Index Ventures.

9. PingPong Payments

Cross-border e-commerce payment platform PingPong Payments was established in 2015 to help e-commerce sellers keep more of their hard-earned profits. More than 43,000 e-commerce merchants around the world selling through Amazon, Newegg, Wish and other e-commerce platforms use PingPong Payments to save money on cross-border payments, VAT payments, supplier payments and more.

In a few short years, PingPong Payments has become one of the biggest cross-border payment processing companies in China processing more than $10 billion for global e-commerce sellers through 2019. The company was named to the 2018 CB Insight Fintech 250 List of Fastest-Growing Fintech Startups.

PingPong Payments was founded by Robert Chen, previously a manager at Deloitte Consulting in New York City, and Wang Ning, a former CFO of PayPal China. The company is headquartered in Hangzhou, Zhejiang, also the home of Alibaba, and has more than 400 employees in the U.S., Europe, and Asia.

In April 2019, PingPong Payments raised a Series D round of funding in an undisclosed amount from Golden Plum Capital and Sunyard Corp. It previously raised a $102M Series C round in 2018. The company also has the backing of CICC, one of China’s leading investment banks.

10. Burning Rock Biotech

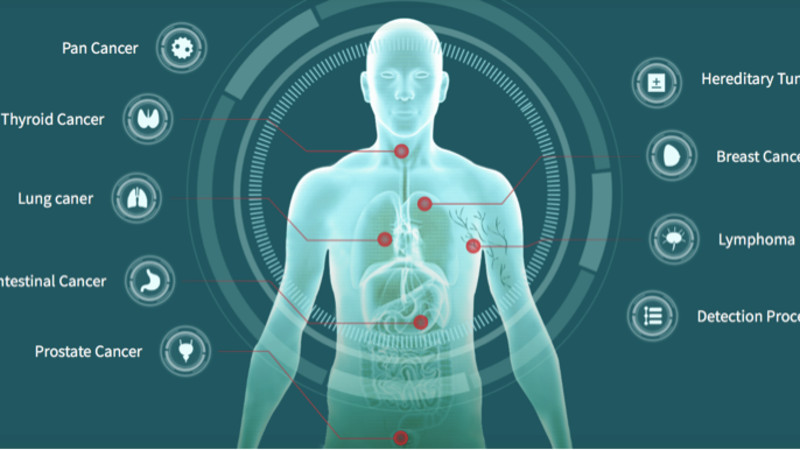

Founded in 2014 by Han Yusheng, Burning Rock Biotech specializes in next-generation sequencing-based (NGS-based) cancer therapy selection tests that are used to assist physicians in choosing the most effective therapy for cancer patients. The company currently offers 13 NGS-based tests applicable to various cancers, including lung, gastrointestinal, breast and prostate cancer, among others.

In 2018, the Burning Rock-CTONG laboratory was one of the first laboratories to pass the technical review of a “NGS laboratory” at China’s National Center for Clinical Laboratories (NCCL), becoming the only clinical laboratory in China to have obtained all three official recognitions from China’s NGS laboratory authority, the U.S. College of American Pathologists (CAP) and the U.S. Clinical Laboratory Improvement Amendments (CLIA).

The company, which is based in Guangzhou, has also collaborated on clinical trials and research with leading pharmaceutical companies such as Johnson & Johnson, AstraZeneca and Bayer.

On May 22, Burning Rock filed for a U.S. initial public offering making it the latest Chinese company to elect a U.S. listing amid new restrictions on IPOs imposed by U.S. regulators. Previously, Burning Rock closed a RMB 850M (US$120M) Series C round in February 2019 led by GIC, the Singapore-based sovereign wealth fund. LYFE Capital, CMB International Capital, Lilly Asia Ventures, Sequoia Capital China and T&Brothers Capital also contributed to the financing. This round adds to a RMB 300M (US$42M) Series B round that Burning Rock raised in 2016.

--

Fei Chu is a VC associate in Beijing, curious observer of the startup world, and an avid reader and writer of all stuff. Stanford alum. China native.

Update: On June 21, Agora announced the launch of an initial public offering of American depositary shares (ADSs). The company applied to list its ADSs on the Nasdaq Global Select Market.

Should your company have made this list?

Join or create your company at The Org, or send us an email at hello@theorg.com. We want to hear your feedback, comments and suggestions!