- Iterate

- Meet The Team

- Of 2021’s Most Valuable IPOs, These Are The Companies With the Most Women on Their Boards

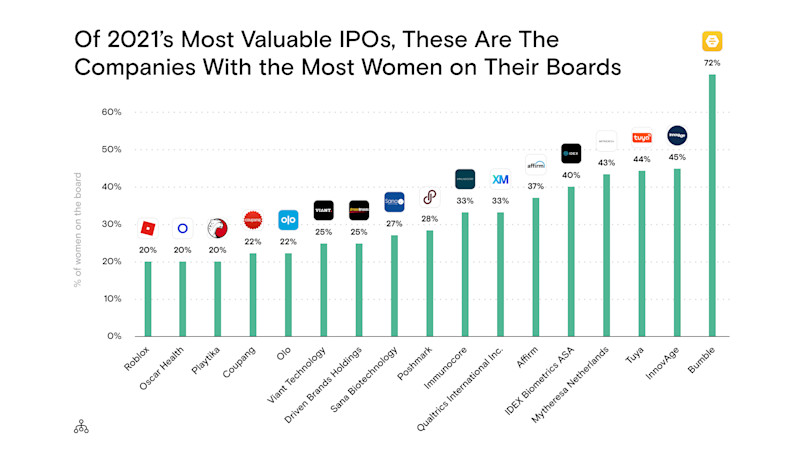

Of 2021’s Most Valuable IPOs, These Are The Companies With the Most Women on Their Boards

Table of contents

Last year, amidst the pandemic and economic rollercoaster, one stand out success was IPO listings. How does gender diversity stack up on the boards of companies that have listed an IPO this year? The Org evaluated boardroom composition of the 29 companies that have gone public in 2021 with an IPO price of $20 or more.

Our data

Women-first dating app company Bumble Inc. stands out for all the right reasons when it comes to boardroom gender diversity. In February, Whitney Wolfe Herd became the youngest woman to take a company public at 31, and she did so with the extremely rare situation of having a more than 70% female board – eight of eleven members are women.

When asked by Fortune whether she was also looking to reach female public market investors, she said she had met with “tons of women,” and there was a real emphasis on “diversifying the team that touched this and the team that’s investing in this.”

It seems hiring a diverse team is an ingrained part of Bumble’s strategy. A spokesperson for Bumble told The Org that from the very beginning of the hiring process, they actively seek out diverse candidates. She said their careers page "strongly encourages people of color, lesbian, gay, bisexual, transgender, queer, and non-binary people, as well as individuals with disabilities to apply".

In its listing, Bumble Inc. raised $2.2 billion with shares priced at $43, above the initial range set for the offering. The company includes the women-first dating app and Badoo, a popular dating app outside the U.S. Of all the companies on our list, Bumble Inc. raised the second highest amount in its listing at $2.5 billion, behind Coupang’s $3.6 billion.

Mytheresa, the Munich-based luxury fashion retailer, is one of the few profitable luxury e-commerce players around. It has 43% female representation on its board, with women holding three of seven seats. The company went public on Jan. 21 with shares priced at $26 and raised $406 million. A sucessful first day of trading ended with the share price at $31, up 19% from the offering price on the New York Stock Exchange.

Affirm - which had the highest share price on the list at $46, InnovAge, and Tuya are the only others with more than 40% of seats being held by women, while Qualtrics and Immunocore are both above 30% at 33%.

Poshmark, which went public on Jan. 15 raising $277 million, famously has tennis superstar Serena Williams on the board alongside Jenny Ming. The two women hold 27% of board seats. The other eight companies who have between 20% and 30% female representation are Sana Biotechnology (27%%), Driven Brand Holdings (25%), Viant Technology (25%), Olo (22%), Coupang (22%), and Playtika, Oscar Health and Roblox all with 20%.

At the opposite end of the list, Motorsport Games Inc., Pharvaris and TELUS International all listed their IPOs without any female board members.

The full list: The number of women on the boards of companies that have IPOd at $20 or more in 2021

| Companies | Board Members (Women / Total) | Share of women (%) | | :---------- | :---------- | :---------- | | Bumble | 8/10 | 73% | | InnovAge | 5/11 | 45% | | Tuya | 4/9 | 44% | | Mytheresa Netherlands | 3/7 | 43% | | IDEX Biometrics ASA | 2/5 | 40% | | Affirm | 3/8 | 37% | | Qualtrics | 3/9 | 33.3% | | Immunocore | 2/6 | 33% | | Poshmark | 2/7 | 28% | | Sana Biotechnology | 3/11 | 27% | | Driven Brands Holdings | 2/8 | 25% | | Viant Technology | 1/4 | 25% | | Olo | 2/9 | 22% | | Coupang | 2/9 | 22% | | Playtika | 1/5 | 20% | | Oscar Health | 2/10 | 20% | | Roblox | 1/5 | 20% | | Cullinan Oncology | 1/6 | 16.6% | | ON24 | 1/6 | 16.6% | | Sun Country Airlines | 1/6 | 16% | | Instil Bio | 1/7 | 14% | | Bolt Biotherapeutics | 1/8 | 12.5% | | Apria | 1/9 | 11% | | Signify Health | 1/9 | 11% | | Score Media | 1/9 | 11% | | Shoals Technologies | 1/10 | 10% | | Motorsport Games | 0/5 | 0% | | Pharvaris | 0/7 | 0% | | TELUS International | 0/8 | 0% |

Why does it matter?

On top of the moral reasons boardroom diversity should be a company’s top priority, there is also an increasing amount of research showing the positive effects diversity has on a company’s bottom line, public standing and investor relations.

Apple, Microsoft, Alphabet and Facebook - four of the five largest companies on Nasdaq by market value – all have boards where white men are in the minority, highlighting the growing recognition of the importance of diversity by major companies.

New research by advocacy group 50/50 Women on Boards shows a positive shift in board diversity, with women holding 24% of board seats across companies that made up the 25 largest IPOs of 2020. Of those 25 companies, 10 companies had three or more women directors. However, it also found women of color still held the fewest board seats, just under 5%, across the Fortune 500 largest publicly-traded companies.

50/50 Women on Boards CEO Betsy Berkhemer-Credaire said the progress was promising, but more had to be done.

"Having women on boards is good for business, from better profitability and productivity, to improvements in workplace culture. It's unfair that publicly traded companies would deprive their shareholders of this business advantage,” she said.

Goldman Sachs, Nasdaq push companies in the right direction

When Goldman Sachs, one of the country’s largest investment banks and a key underwriter of corporate stock offerings, announced last year it would only take a company public if it had at least one woman or minority director, it was a wakeup call to corporate America.

Goldman Sachs CEO David M. Solomon said last year the company would increase that minimum to two during 2021.

“We’re already bearing witness to the progress made, including several board placements, and are galvanized to further build on this momentum as we continue to advance these goals,” he said, adding there was still a lot of work to do.

After Goldman Sachs announced its policy, Nasdaq, one of the largest stock exchanges in the world, filed a proposal with the Securities and Exchange Commission (SEC) to adopt new listing rules on boardroom diversity and disclosure. If accepted, all companies listed on Nasdaq's U.S. exchange would have to have at least two diverse directors – one who self-identifies as female and one who self-identifies as either an underrepresented minority or LGBTQ+ -- within the next four years, or explain why they do not.

In a statement, Nasdaq said the goal of the proposal was to provide stakeholders with a better understanding of board compositions and enhance investor confidence, and it was based on more than two dozen studies that related board diversity with improved company performance.

Nasdaq President and CEO Adena Friedman said Nasdaq’s purpose was to champion inclusive growth and prosperity to power stronger economies. “We believe this listing rule is one step in a broader journey to achieve inclusive representation across corporate America.”

Nasdaq will also partner with Equilar to provide a diversity network for Nasdaq-listed companies to help them reach diverse board-ready candidates. Nasdaq Stock Exchange President Nelson Griggs said corporate diversity at all levels opened a clear path to innovation and growth, and he looked forward to working with companies of all sizes to create stronger and more inclusive boards.

External pressures for internal change

The New York Stock Exchange is taking a more cautious approach towards increasing its companies female and minority representation in the boardroom.

It has established the NYSE Board Advisory Council, designed to identify and connect diverse candidates with NYSE-listed companies seeking new board members. It plans to launch an online directory of all the diverse candidates nominated by the NYSE Board Advisory Council, which will be available to NYSE-listed companies.

And it’s not just the private sector making moves towards increasing diversity in the boardroom. California made headlines when it imposed mandatory diversity standards on companies headquartered within its borders.

In 2018, the state announced it would require public companies based in the state to have at least one female director by the end of 2020 and as many as three by the end of 2021. There are already other states following suit, with similar legislation introduced in Illinois, Massachusetts, New York, New Jersey and Washington.

As American Civil Liberties Union Executive Director Anthony Romero said of Nasdaq’s proposed policy, the time for incremental change is gone, as society holds “corporate America’s feet to the fire.”

“With increased representation of people of color, women and LGBTQ people on corporate boards, corporations will have to take actionable steps to ensure underrepresented communities have a seat at the table."

Newly-appointed Starbucks’ Chairwoman Melony Hobson, who served on Starbucks’ board for 16 years before rising to the top spot and becoming only Black chairwoman of a Fortune 500 company, told Wall Street Journal: “The broader society is keeping score, there are consequences that exist for not living up to those commitments.”

--

The Org is a professional community where transparent companies can show off their team to the world. Join your company here to add yourself to the org chart!

In this article

The ORG helps

you hire great

candidates

Free to use – try today